The Chinese Consumer. 5 Trends & insights.

Extensive research by McKinsey shows some recent trends.

Here we can also see the role that ‘post 90’s generation’ play as the engine of the new economy.

# 1 Consumers have confidence but risks remain.

Consumers continue to spend money and this is also supported by more research than just the results of Singles Day. The growth in incomes is still rising, however, instead of 10.1% in 2012, this has dropped to 6.2% in 2016. Chinese people also increasingly spend more on convenience and luxury products. On the other hand, they are faced with all time high housing prices, especially in the Tier 1 cities. Therefore, an ever larger share of their disposable income is spent on living costs. China is also struggling with an aging population. Over time, costs for healthcare will become a heavier burden for the society.

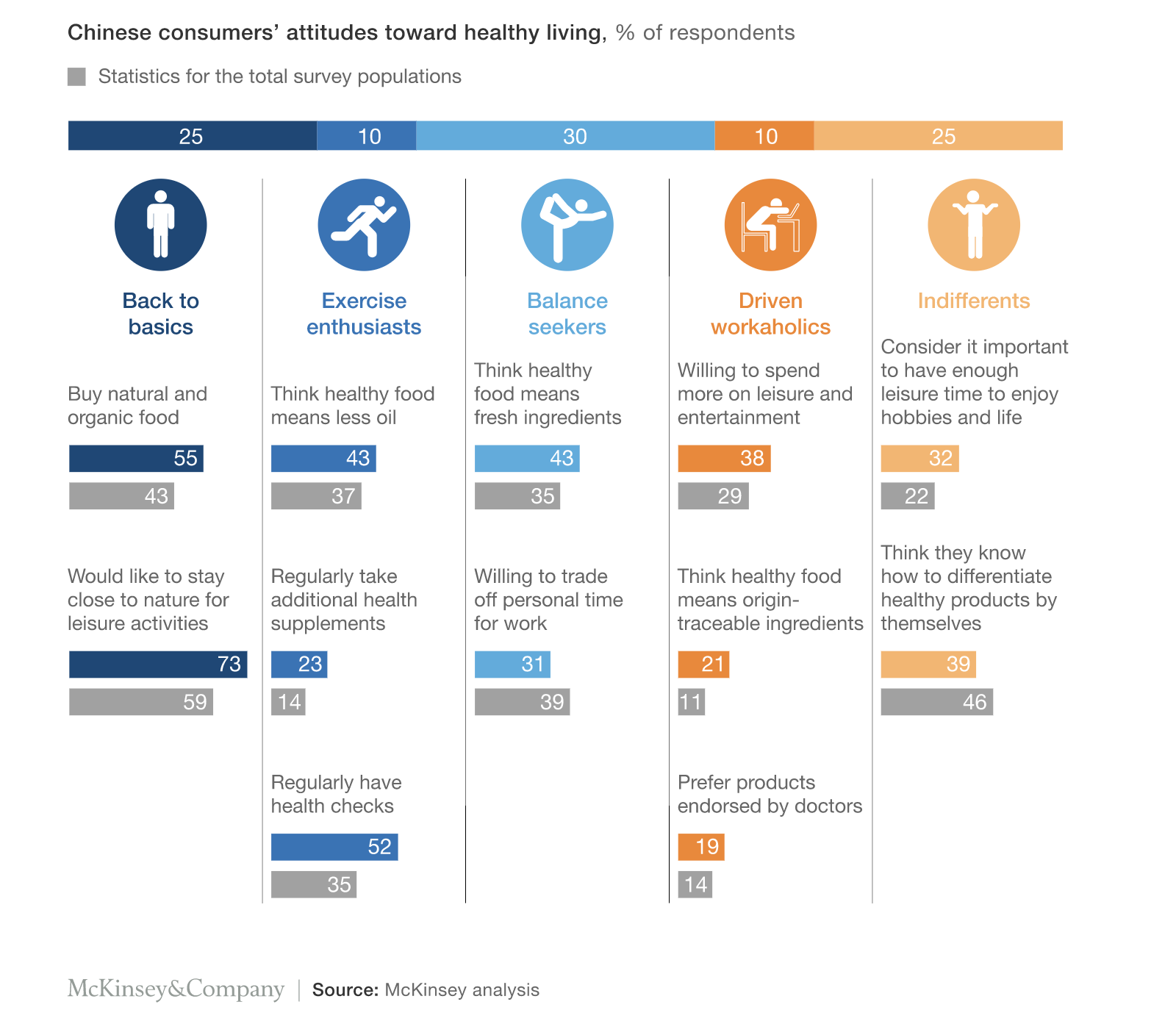

# 2 Consumers are more aware of their health. However, different groups define health differently.

In their research, McKinsey found that 65% of the Chinese people were consciously occupied with their health in their target group. The government has also launched an explicit program ‘China Healthy in 2030’. In China, people are struggling with increasing obesity and an increase in diabetes. It is interesting to see how Chinese people approach ‘health’ in different target groups. The figure below shows the 5 target groups that distinguishes their attitudes.

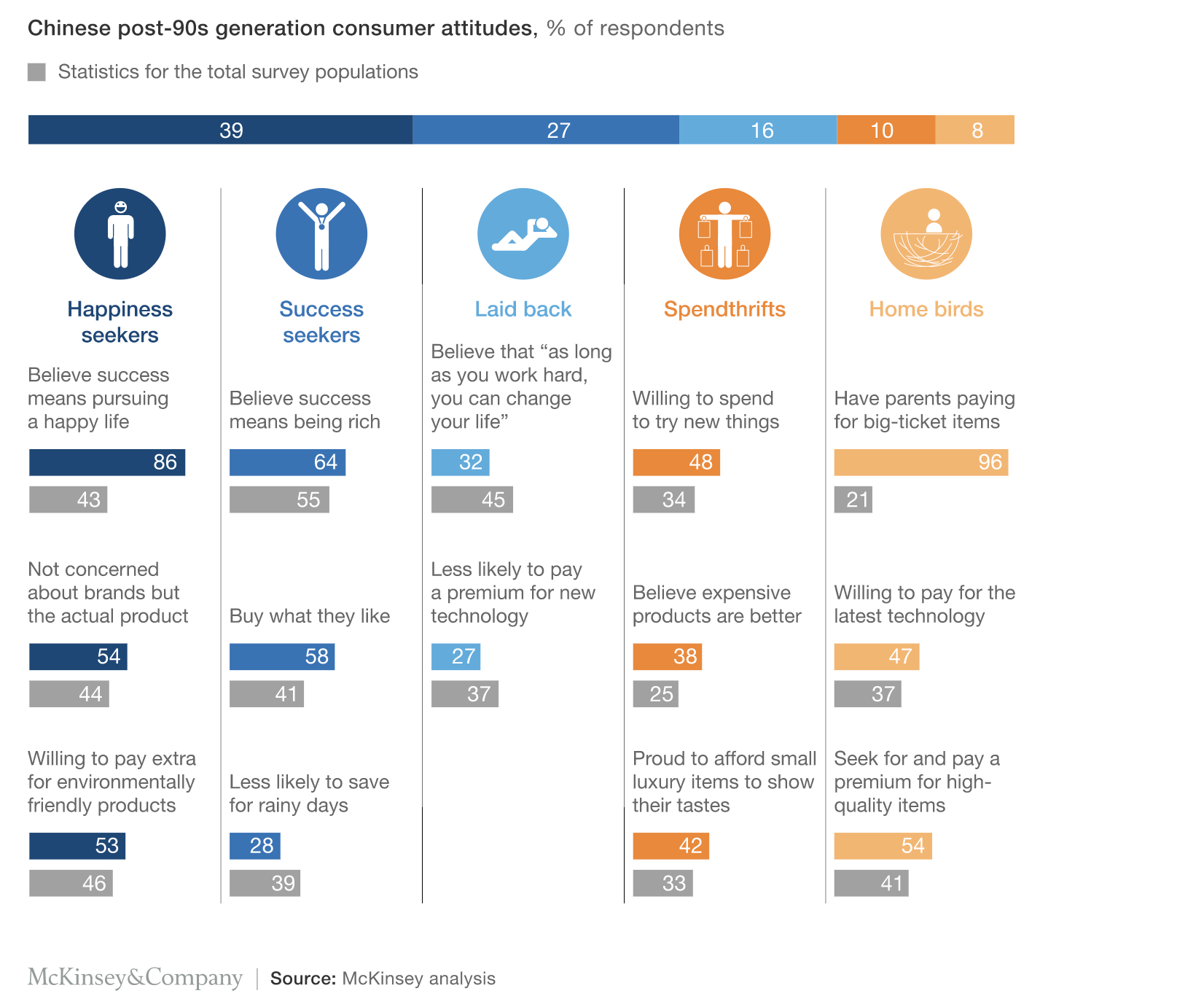

#3 The ‘post 90’s generation’. A new driving force.

They are completely different from our Western Millennials but also different from the rest of the Chinese consumers. This generation has become an important new accelerator for the economy. Unlike the older generations, they grew up in unprecedented prosperity. They represent about 15% of the Chinese population and in 2030 they are expected to account for 20% of the growth in consumption, more than any other demographic target group. They have a unique attitude towards matters such as health, happiness, success, brands and products. McKinsey divided them into the 5 categories below.

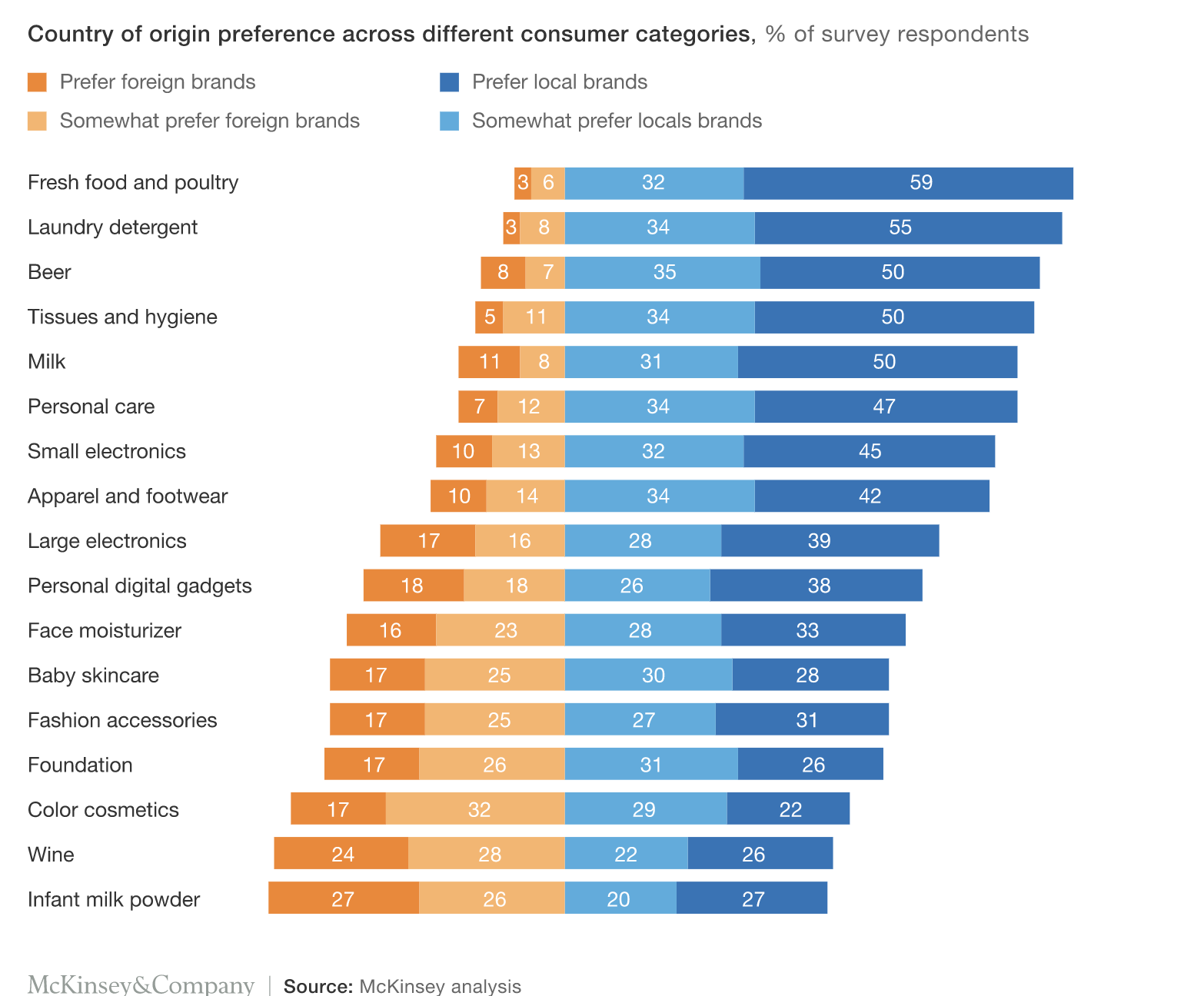

# 4 An increasingly nuanced picture of brands and products.

There was a period where Chinese consumers had a strong preference for more international brands on several types of products. However, this become somewhat more nuanced over time. There is still a growing demand on the market for good products from abroad, but consumers in China are becoming more and more aware.

The graph below shows the preferences of consumers based on local and international brands for each category.

#5 Last but not least : Value for money.

The Chinese market is becoming more mature and this is reflected by the behavior and attitude of consumers. They have their own unique view of the market. The most important trend is Value for Money. The Chinese consumer is certainly prepared to pay for value and also has the means to do so. However, he / she sets requirements for service and quality and has expectations that need to be fulfilled. Chinese own brands are also getting better value, a good example is Huawei : which is of high quality, provides a good service and in its pricing level is also below the competition.

A solid plan to enter the Chinese market, still has a high potential for foreign brands. To understand and approach the Chinese consumer in the right way is essential. The positioning of your product is also very important and can be very different than in the West.

Want to know more about successfully entering the Chinese market?

Source: McKinsey ‘Double-clicking on the Chinese consumer’