Cycling Boom 2024: Premium Imports and Component Innovations Spark Growth in China’s Bicycle Market

The Chinese bicycle market has maintained its impressive growth trajectory into 2024, continuing the momentum from previous years. Cycling has evolved beyond a simple recreational activity into a serious lifestyle choice for millions of consumers. Enthusiasm for cycling remains at an all-time high, and the demand for a variety of bicycles is becoming increasingly diverse. Emerging brands, technological innovations, and shifting consumer preferences are all contributing to profound changes within the market, creating new opportunities and reshaping the industry landscape. With the ongoing evolution of consumer needs and technological advancements, the market is brimming with unparalleled potential.

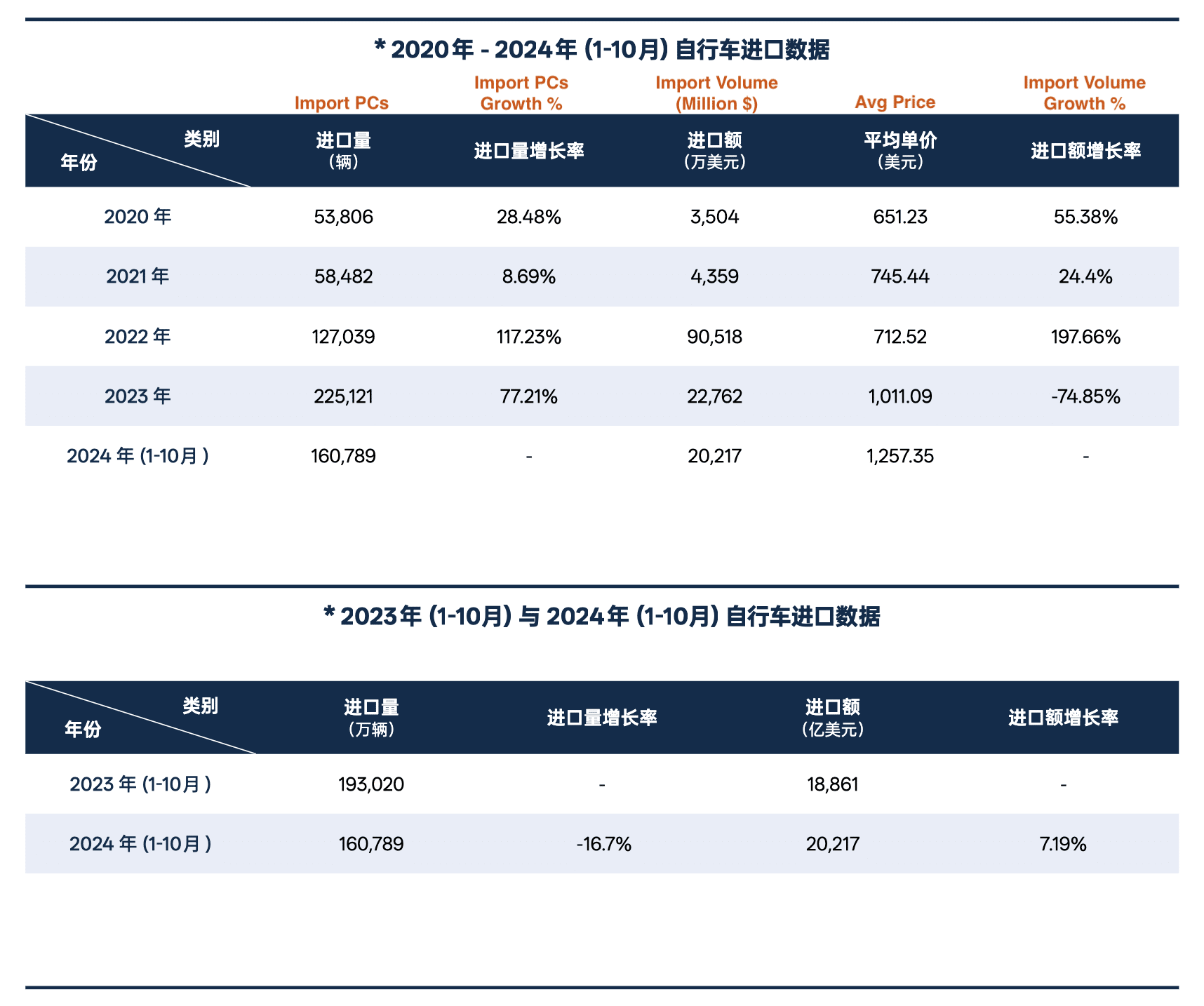

Premium Bicycle Imports on the Rise

When examining bicycle imports in China, competition-type and mountain bikes continue to dominate the landscape. In the first ten months of 2024, China imported 160,000 bicycles, reflecting a slight dip of 30,000 units compared to the previous year. Despite this decrease in total import volume, the value of these imports has seen a remarkable recovery. The average import unit price for bicycles has risen sharply to $1,257, a $300 increase compared to the same period in 2023. This shift toward higher-end bicycles is indicative of growing demand for premium models, as Chinese consumers increasingly prioritize quality and performance over budget-friendly options. The trend is especially pronounced among urban professionals, cycling enthusiasts, and athletes, who are willing to invest in advanced technology and superior designs.

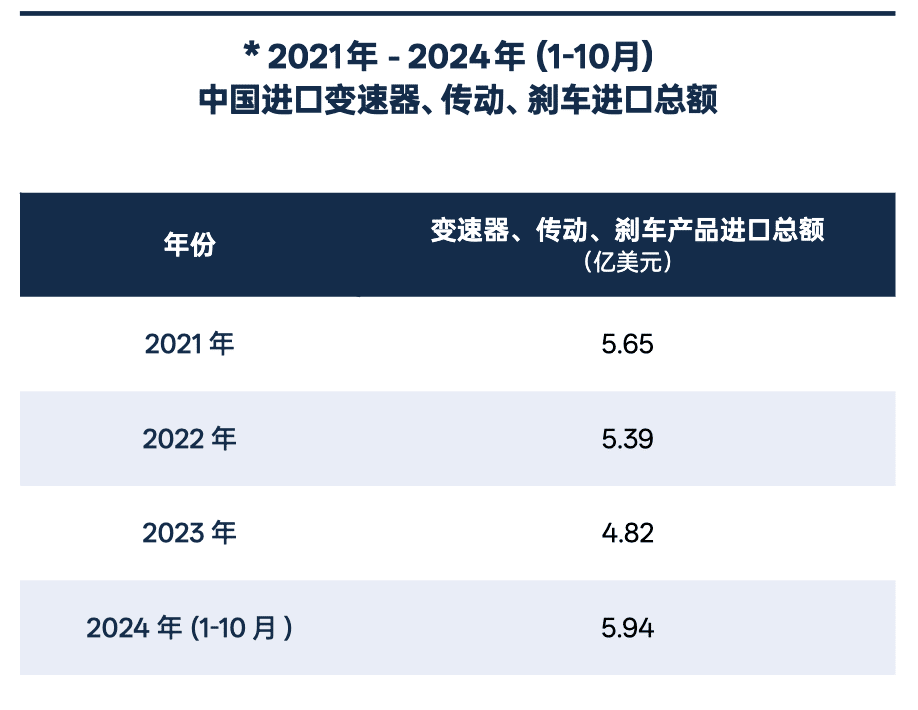

High-End Components Drive Market Growth

The global bicycle component supply chain has stabilized in 2024, with a strong resurgence in demand for premium components. High-end bicycle parts such as gear systems, drivetrains, and brakes have seen significant growth, driven by evolving consumer expectations for top-tier performance. Data shows that from January to October 2024, China’s total import value of bicycle components reached an all-time high of $594 million, reflecting a 48.47% year-on-year increase. This surge in component imports underscores a renewed market confidence and a clear consumer preference for high-performance, long-lasting parts that enhance the cycling experience. Premium brands and manufacturers are capitalizing on this growing demand, offering products that blend innovation, durability, and advanced technology.

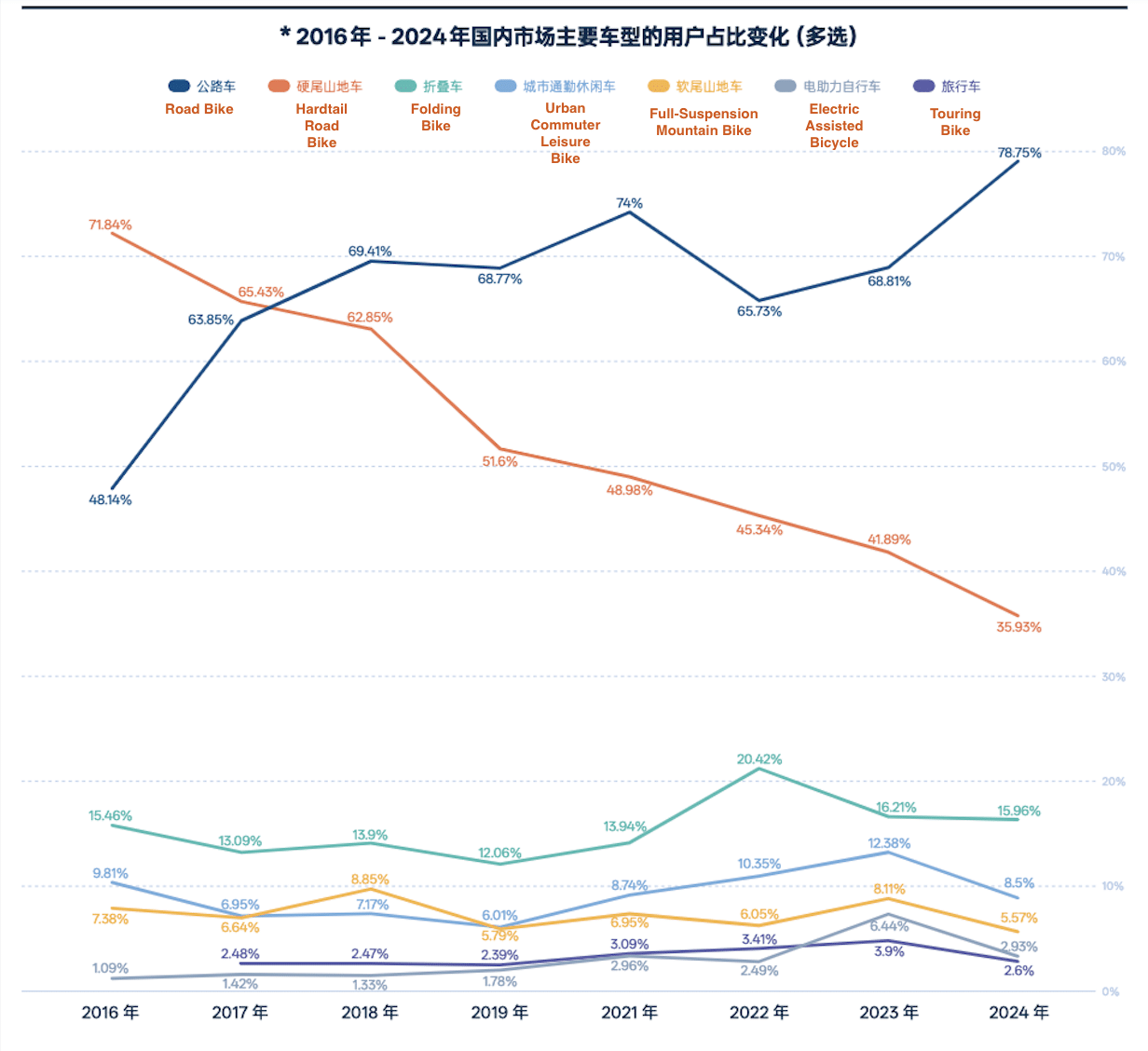

Shifting Market Dynamics: The Rise of Road Bikes

2024 marks a pivotal year for road bikes, which have gained significant traction among Chinese consumers. Road bike ownership reached 78.75% in 2024, setting a new historical high. This shift represents a departure from the dominance of mountain bikes, whose market share has been in steady decline. Road bikes are now favored for their versatility, speed, and suitability for urban environments, making them the go-to choice for daily commuting, fitness, and recreational cycling. This transformation highlights a broader shift in consumer preferences toward lightweight, high-performance models that meet the needs of modern, active lifestyles. Conversely, the market share of electric-assisted bicycles, urban leisure bikes, and touring bikes has seen a decrease compared to the previous year. Folding bikes have remained a niche segment, maintaining stable demand.

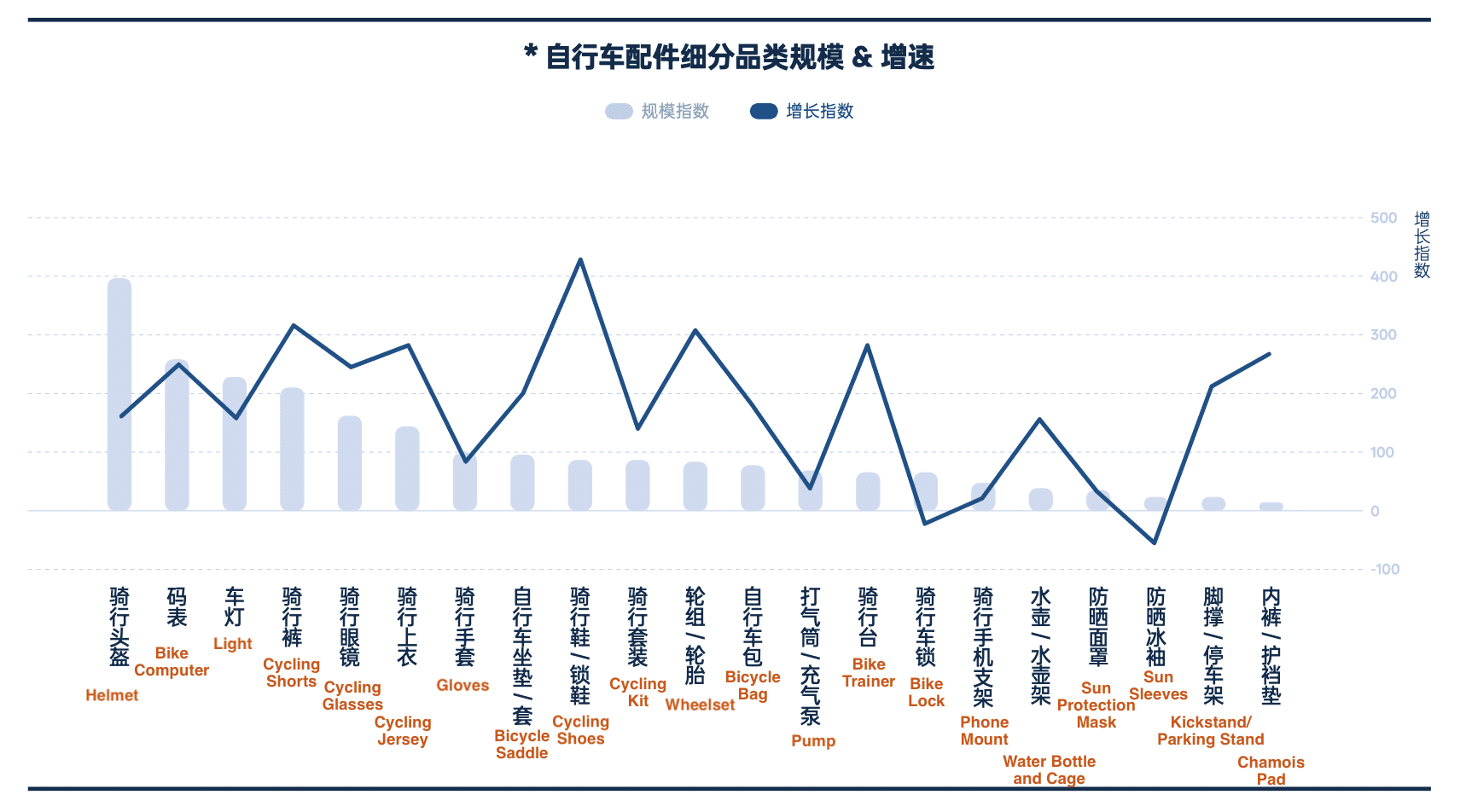

Booming Demand for Cycling Accessories on E-commerce Platforms

One of the most notable trends in the 2024 Chinese bicycle market is the explosive growth in demand for cycling accessories, which has consistently outpaced the growth of complete bicycles. On platforms like JD.com, sales of cycling helmets, bike computers, lights, cycling pants, cycling glasses, and jerseys have surged in popularity. Notably, cycling helmets, glasses, bike computers, and cycling shoes have seen the most rapid growth, as consumers seek products that enhance safety, performance, and comfort. As cycling becomes a more integrated part of people’s daily lives, cyclists are increasingly investing in accessories that improve both their cycling experience and overall well-being. On the other hand, demand for bike locks and phone holders has remained relatively sluggish, signaling that consumers are prioritizing high-performance gear over basic functional accessories.

Key Trends: Premium Products and Evolving Consumer Preferences

In conclusion, the Chinese bicycle market in 2024 is defined by sustained growth, with an evident shift toward premium products and specialized components. The import of competition-type and mountain bikes remains robust, but the growing preference for higher-end models is unmistakable, reflected in the rising average import prices. The demand for high-quality bicycle components is soaring, demonstrating a commitment from Chinese consumers to invest in performance-driven products. Additionally, consumer preferences are evolving as road bikes rise in popularity, while other bike categories such as mountain bikes and electric-assisted bicycles see a decline in market share. The accessory market is booming, with specific product segments, like helmets, computers, and apparel, experiencing particularly strong growth.

Looking to Tap Into the Booming Cycling Market in China?

With the rapid growth of premium bicycles and accessories in China, international brands now have an exciting opportunity to enter this flourishing market. Consumers are looking for innovation, performance, and quality, whether they’re purchasing competition bikes, mountain bikes, or high-end components. The increasing demand for top-tier products in this sector presents a significant growth opportunity for foreign brands seeking to establish themselves in China. At AsiaAssist, we specialize in helping international brands successfully enter the Chinese market, offering tailored strategies and expert support to ensure your brand’s growth. Contact us today to explore how we can assist in unlocking the vast potential of the Chinese bicycle market.