ISPO Munich 2024 & the Chinese Outdoor Market

Our team participated in ISPO Munich 2024, one of the world’s leading trade shows for the outdoor and sports industry. The event brought together over 2,400 exhibitors from 50 countries, showcasing the latest innovations in outdoor gear, technology, and sustainability.

ISPO Munich 2024: Key Highlights and Innovations

At ISPO Munich 2024, sustainability and technological innovation were at the forefront. Brands presented a wide array of cutting-edge products, including:

- Eco-friendly Outdoor Apparel: Many brands introduced products made from recycled materials and adopted energy-efficient production methods.

- Smart Outdoor Gear: Innovative jackets, hiking boots, and backpacks equipped with technology that tracks physical activity, adjusts to environmental conditions, and provides GPS features.

- Skiing and Mountaineering Equipment: High-performance skis, boots, and mountaineering gear designed for durability and optimal performance in extreme conditions.

- Camping Gear: New tents, sleeping bags, and portable cooking equipment designed for comfort and ease of use in outdoor settings.

- Sports Protection: Advanced protective gear for outdoor athletes, including knee pads, elbow guards, and other protective accessories designed for high-impact activities.

- Recreational Sports Equipment: Traditional and lightweight equipment for outdoor activities, such as frisbees, ideal for casual sports and recreation in nature.

These innovations cater to a growing demand for functional and durable products, which will resonate with tech-savvy Chinese consumers.

The Growth of China’s Outdoor Sports Market

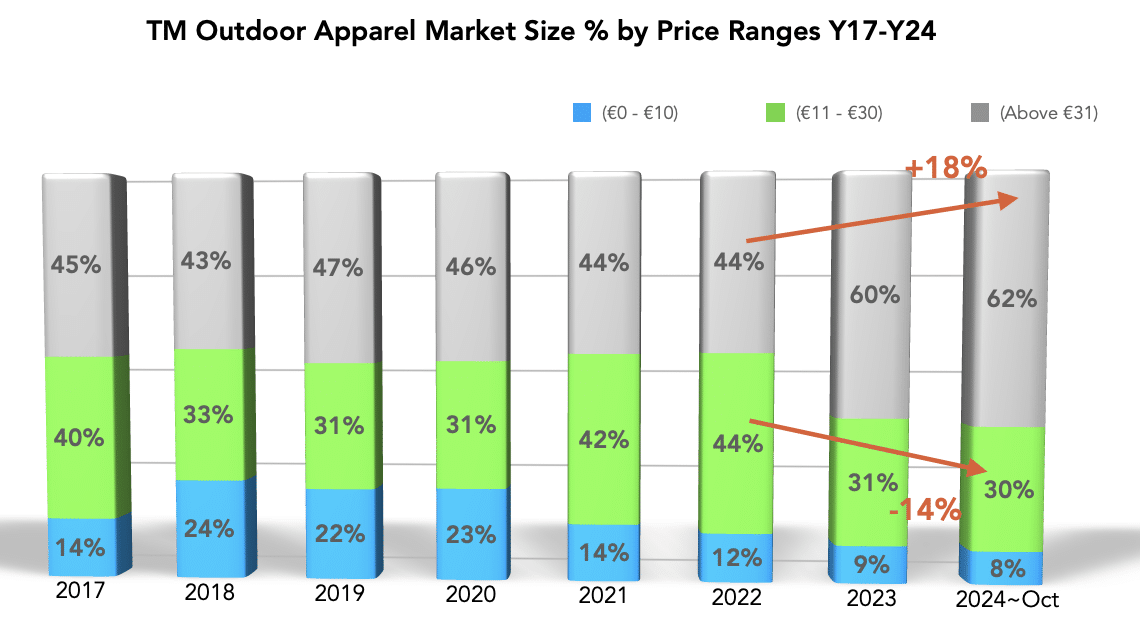

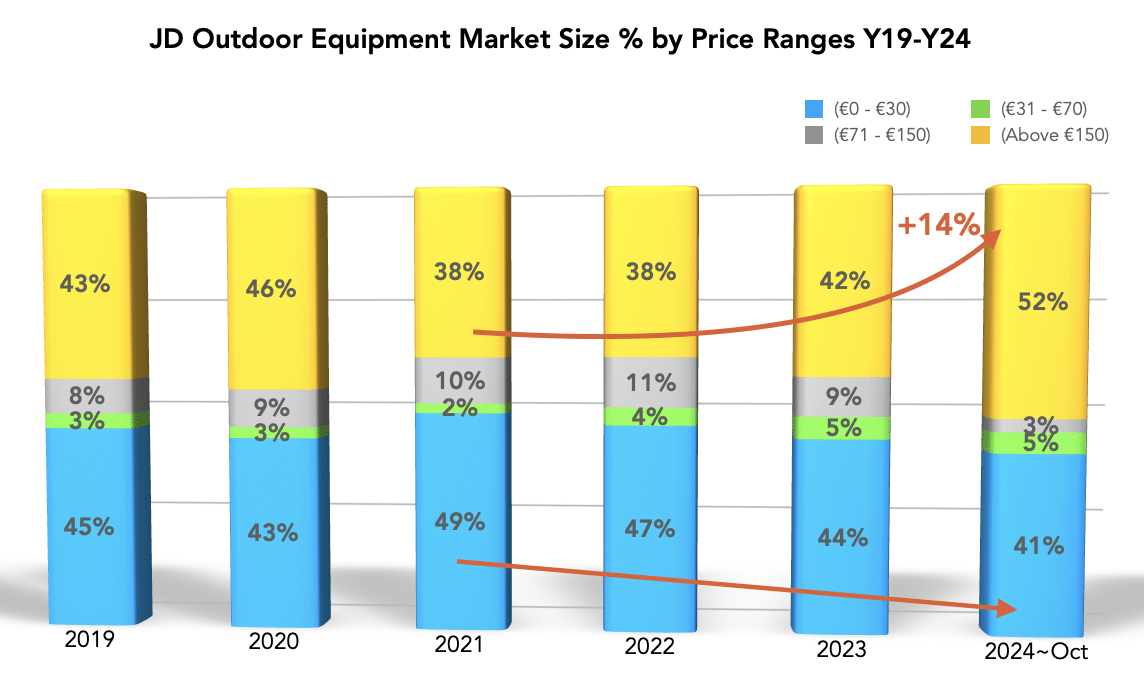

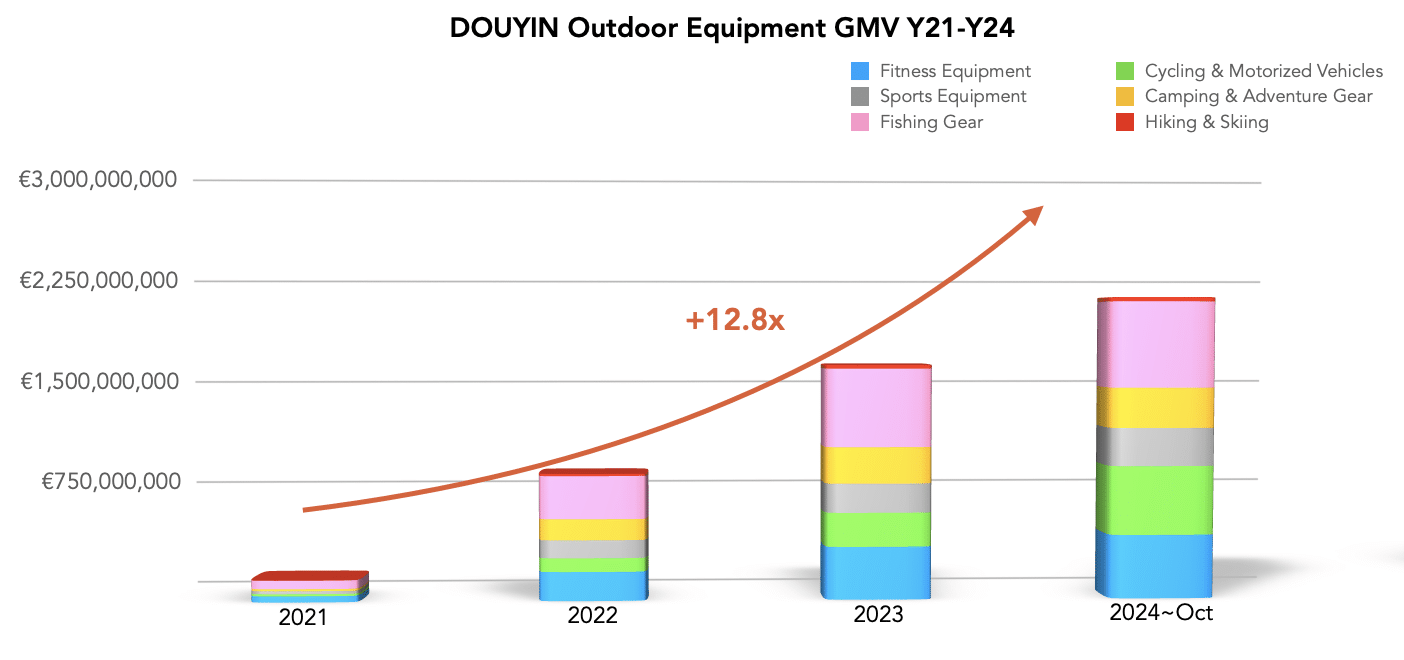

China’s outdoor sports market is expanding rapidly, driven by increased consumer participation in activities like hiking, cycling, skiing, and camping. From 2017 to 2023, the outdoor apparel market on Tmall grew by 78.1%, with significant demand for premium products. Categories like Camping & Adventure Gear and Hiking & Skiing have consistently seen strong growth, reflecting a shift in consumer priorities toward more specialized, higher-quality products.

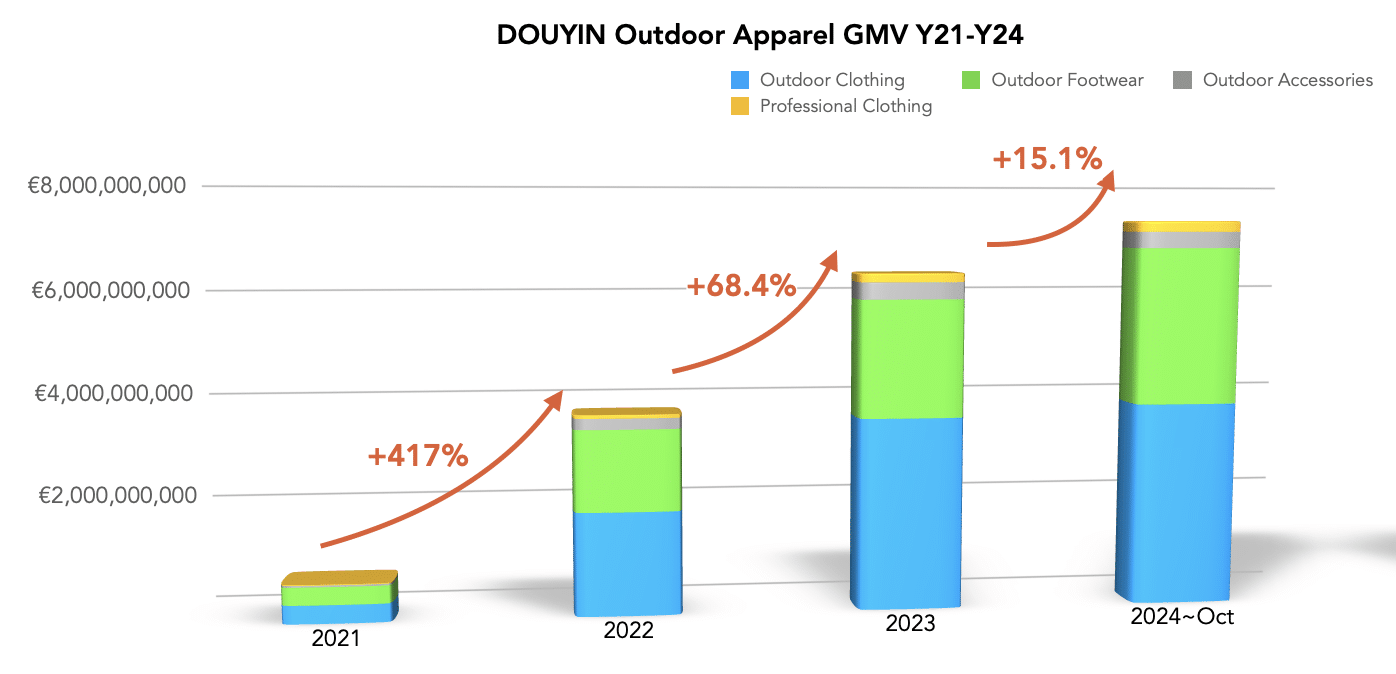

Douyin’s Role in Driving Growth through Social Commerce

Douyin (Chinese TikTok) continues to lead the way in social commerce. From 2021 to 2022, Douyin’s apparel outdoor market grew by 417%, and it has continued to see substantial growth since then, demonstrating the platform’s strong ability to reach Chinese consumers. Through live-streaming, short-form videos, and influencer marketing, brands can connect directly with consumers in an engaging and personal way. This platform is especially powerful for reaching younger consumers who are increasingly using social media to discover products.

Key Opportunities for International Outdoor Brands

- Capitalize on the Premium Product Segment: There is a clear demand for premium outdoor products in China. Chinese consumers are increasingly willing to invest in high-quality, durable outdoor gear that offers superior performance. International brands that offer premium products are well-positioned to succeed in this growing segment.

- Utilize E-commerce for Visibility and Growth: Setting up flagship stores on platforms like Tmall and JD is crucial for building a strong brand presence in China. These platforms are not only sales channels but also tools for brand awareness and consumer engagement.

- Engage Through Social Commerce: Douyin’s rapid growth in outdoor product sales presents a unique opportunity for brands to directly engage with consumers. By using live-streaming and partnering with influencers, brands can build a loyal following and drive sales, especially for premium products.

Conclusion

As the outdoor sports market in China continues to grow, international brands have significant opportunities to capitalize on this trend. By focusing on premium products, leveraging e-commerce platforms, and embracing social commerce, brands can establish a strong foothold in this dynamic market.

At AsiaAssist, we specialize in helping international brands navigate the complexities of the Chinese market. Contact us today to learn more about market insights, consumer behavior, and strategies to boost your brand’s presence in China.