Kind + Jugend 2024 Baby & Mom China Market Analysis

In today’s global marketplace, tapping into China’s e-commerce sector is essential for any baby and maternity brand looking to grow. While it’s true that fewer babies are born each year in China compared to previous decades, the market continues to show resilience in terms of Gross Merchandising Value (GMV). In fact, this landscape presents significant opportunities for brands offering high-quality, innovative, and sustainable products that meet the evolving needs of Chinese consumers.

At AsiaAssist, we specialize in helping global brands navigate the complex and competitive Chinese market. We empower brands to not only enter but thrive in this space. Let’s explore the current state of the market and how AsiaAssist can unlock this massive potential for your brand.

The Surprising Resilience of China’s Baby & Maternity Market

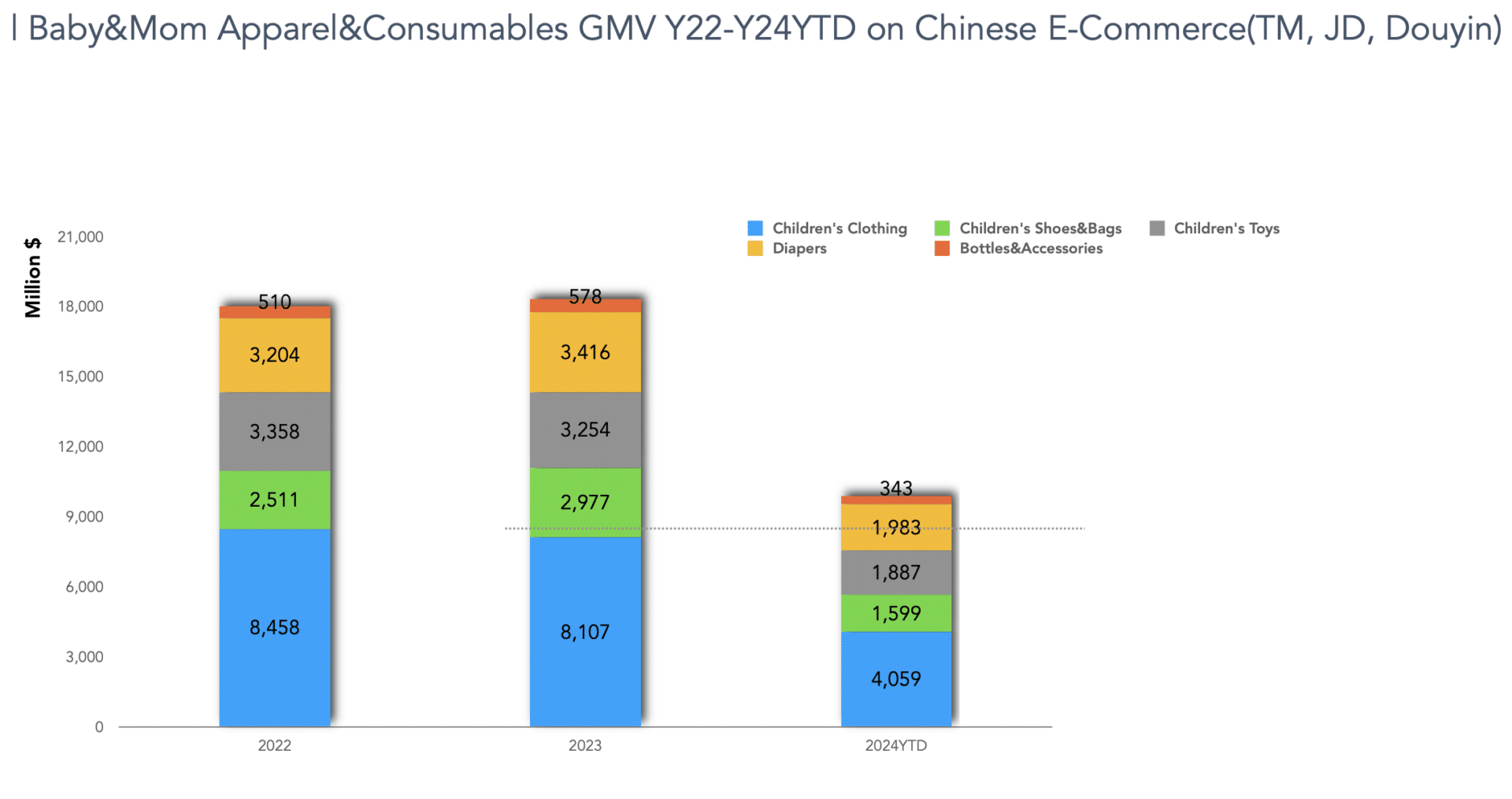

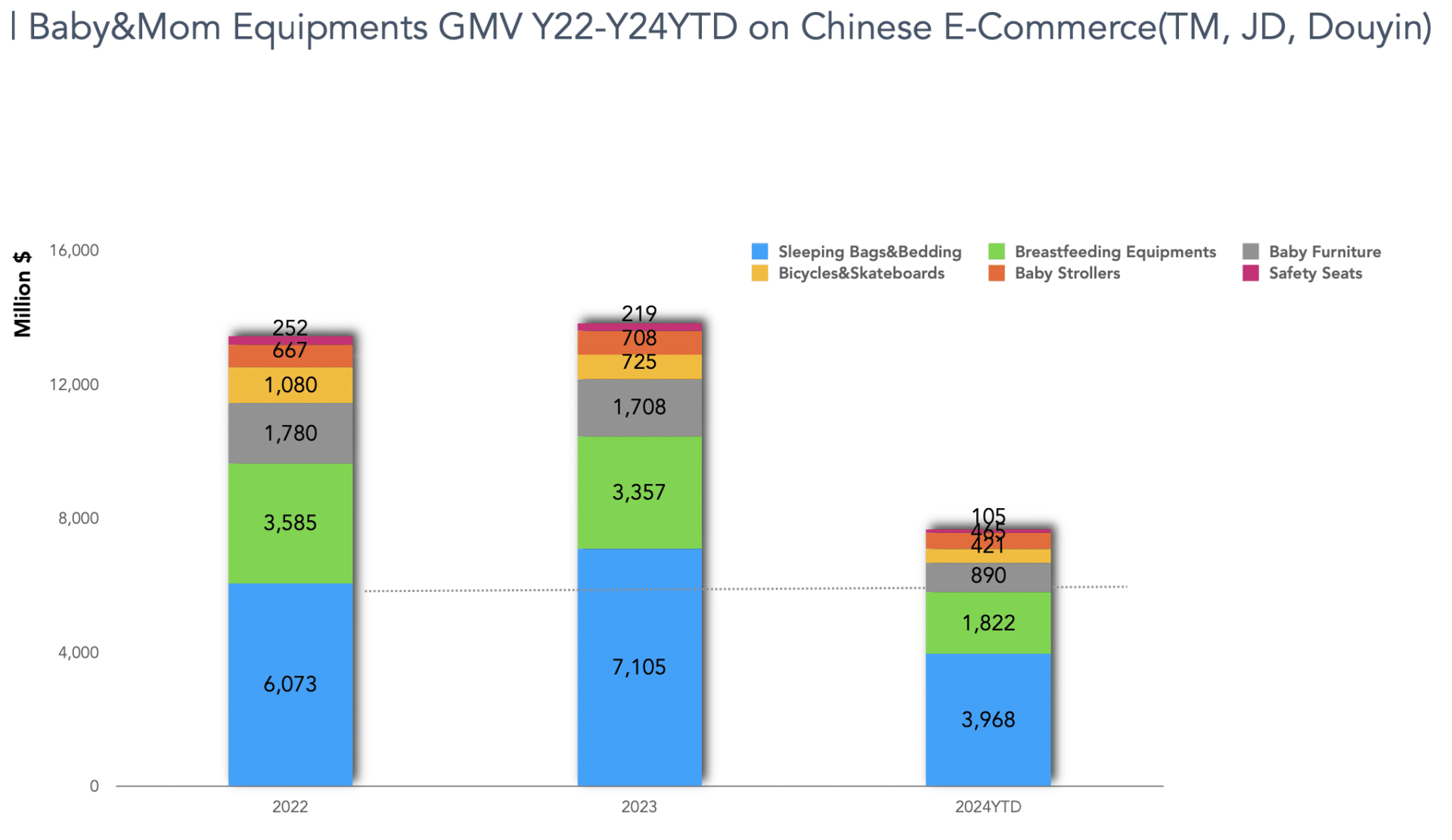

Despite a decline in birth rates, China’s baby and maternity market remains strong, driven by the spending power of its new generation of parents. In 2023 alone, the e-commerce market for baby and maternity products reached $36 billion in GMV. This remarkable figure underlines the spending potential of Chinese parents, particularly in urban areas where affluence is on the rise.

AsiaAssist: GMV for Apparel & Consumables in Baby and Maternity category from 2022 to Aug 2024 on Chinese E-Commerce Platforms

AsiaAssist: GMV for Equipment in Baby and Maternity category from 2022 to Aug 2024 on Chinese E-Commerce Platforms

Here are some key trends driving growth:

– Affluence & Focus on Quality: As Chinese parents’ disposable incomes grow, they are increasingly prioritizing high-quality, premium products for their children. This trend is especially pronounced in categories like strollers, safety seats, feeding equipment, and educational toys.

– Sustainability: Eco-conscious products made from sustainable, non-toxic materials are in high demand, as parents focus on health and environmental sustainability.

– Smart Parenting Solutions: Technology is becoming integral to parenting, with Chinese consumers gravitating towards AI-powered baby monitors, smart cribs, and connected devices.

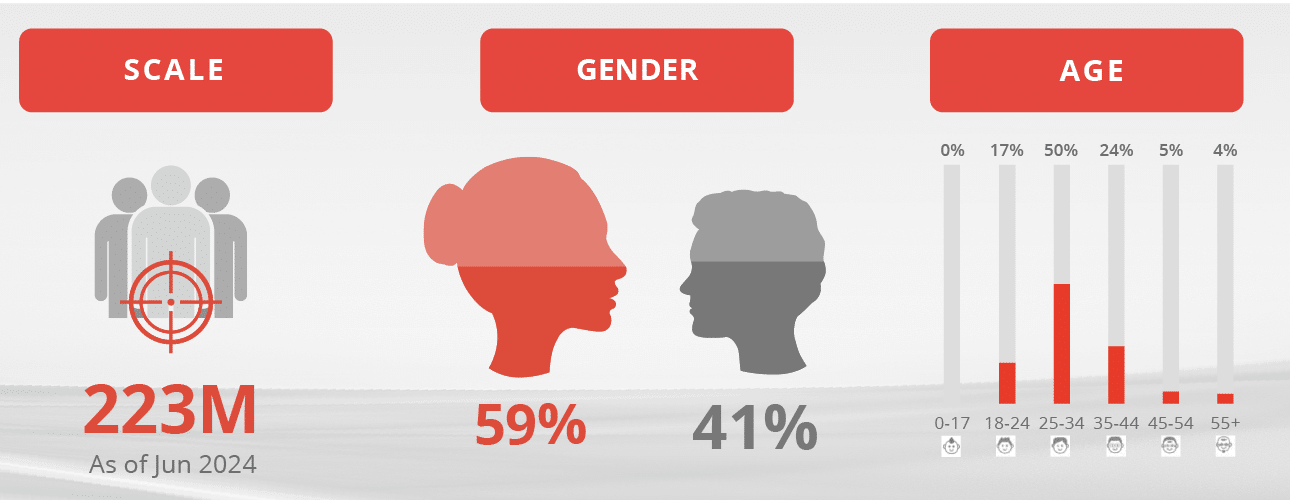

Source: iAudience Data as of July 2024 (Indicates the characteristics of Chinese netizens who actively engaging with the maternity and parenting market on social media)

These trends indicate that, while fewer babies are born, the focus is shifting towards investing in better-quality products that ensure a child’s well-being, safety, and early development. Brands offering innovation and sustainability can capture a significant share of this market.

Kind + Jugend 2024

Kind + Jugend 2024

Insights from Kind + Jugend 2024: A Market Ready for Innovation

At the Kind + Jugend trade fair in September 2024, leading baby and maternity brands showcased cutting-edge products well-suited to China’s e-commerce market. AsiaAssist identified multiple trends that match the needs of Chinese consumers, including:

– Sustainability: Many of the showcased products, such as eco-friendly strollers and toys, appeal directly to China’s post-90s and Gen Z parents. These generations are increasingly concerned with the environmental impact of their purchases, creating a growing market for sustainable brands.

Kind + Jugend 2024

– Innovation: From smart baby monitors to multifunctional cribs, brands are leveraging technology to offer smarter parenting solutions—another key trend in China’s market.

Kind + Jugend 2024

– Omnichannel Engagement: Chinese parents engage with brands across a wide range of platforms, from e-commerce giants like Tmall and JD.com to social commerce channels like Xiaohongshu (Little Red Book) and Douyin (TikTok).

The Power of E-Commerce in China: A Dynamic Landscape

The GMV for baby and toddler products grew by 6.5% in 2024, while maternity products surged by 12% during the same period. These numbers underscore the market’s ongoing strength, even amid demographic changes. What’s driving this growth?

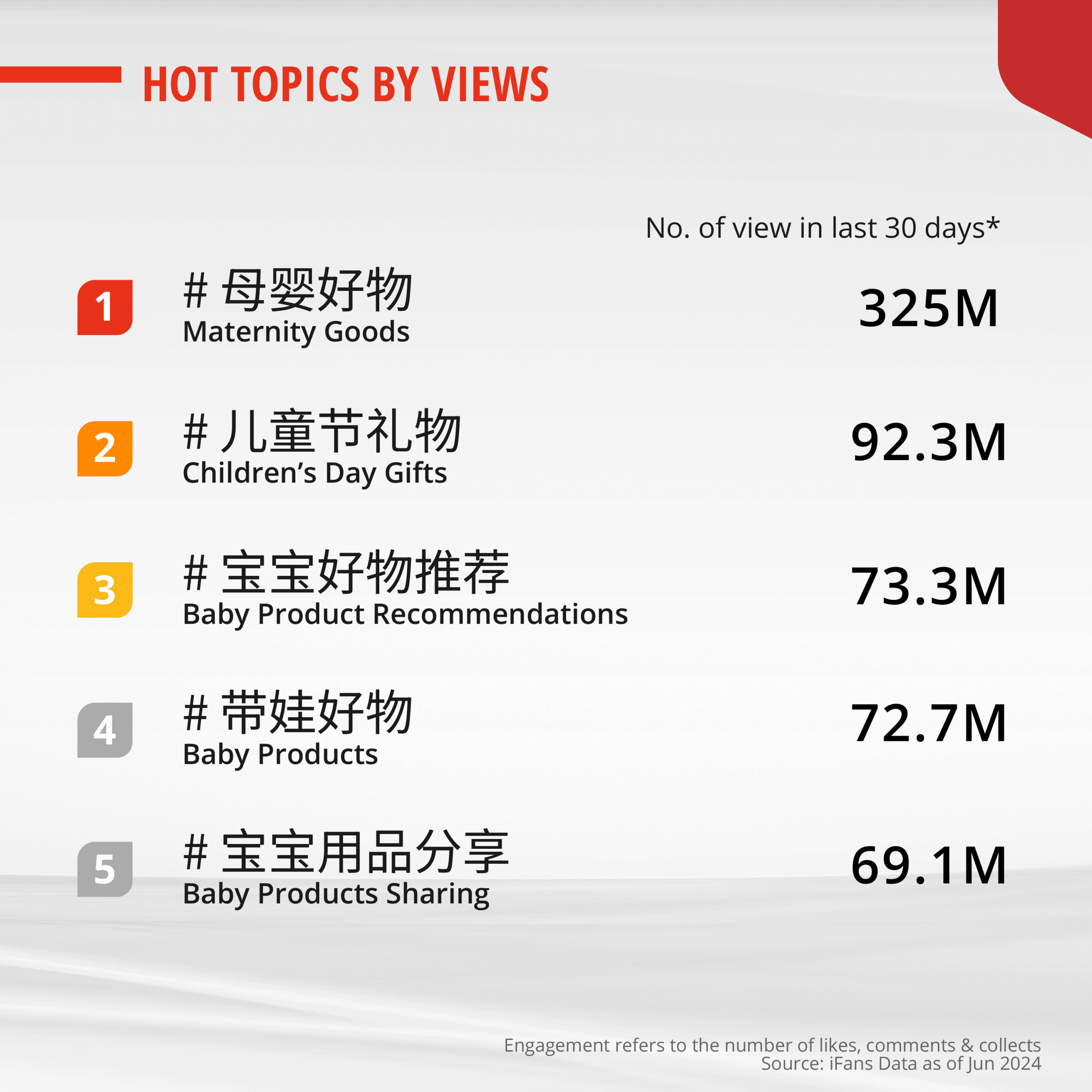

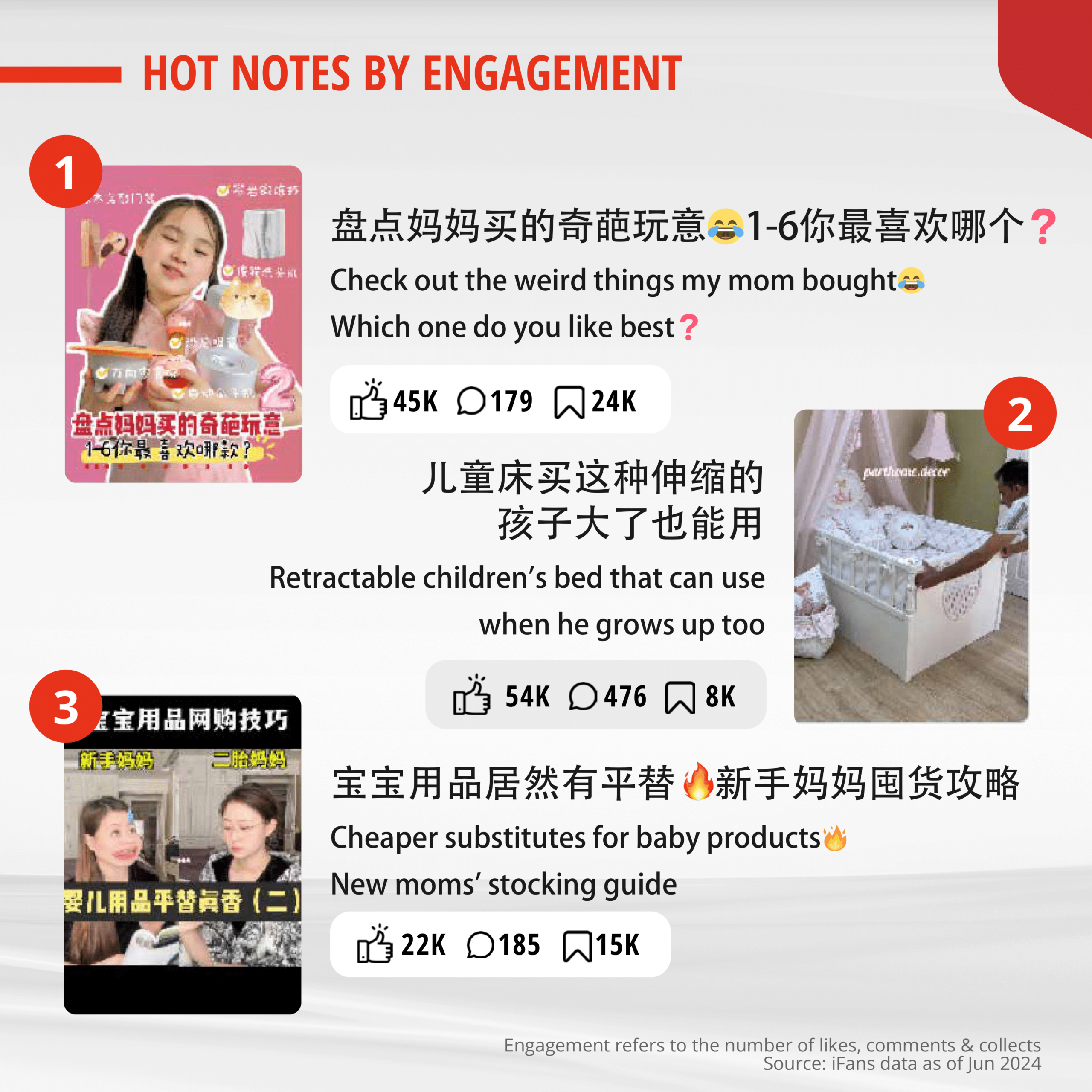

1. E-Commerce Expansion: China’s e-commerce platforms, particularly Tmall and JD.com, have become the go-to shopping destinations for new parents. Additionally, platforms like Xiaohongshu and Douyin offer more intimate social commerce experiences, where parents can share advice and recommend products.

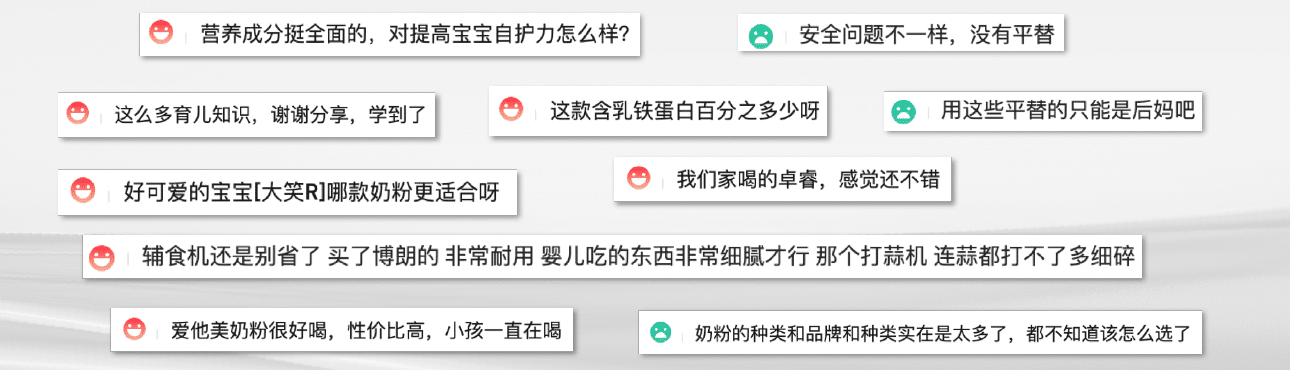

2. Consumer Engagement: Chinese consumers place immense trust in peer recommendations and influencer marketing. Popular hashtags like #新手妈妈 (New Mom) and #育儿神器 (Parenting Essentials) on Xiaohongshu foster a community-driven approach to product discovery and purchase.

Source: iAudience Data as of July 2024

3. Omnichannel Strategy: Success in China’s e-commerce market hinges on omnichannel strategies. Brands must not only establish their presence on e-commerce platforms but also leverage social commerce and influencer-driven content to build trust and engagement.

Source: iFans data June 1–June 30, 2024

Why Partner with AsiaAssist? Your Gateway to China’s E-Commerce Market

Navigating this landscape can be challenging, but that’s where AsiaAssist comes in. Our team has years of experience helping global brands successfully enter the Chinese market. Here’s how we can support your brand:

– Localized Marketing and Product Strategy: We help tailor your brand’s message, products, and marketing strategies to resonate with Chinese consumers. Whether it’s adjusting packaging for the local market or crafting a message that appeals to parental values, we ensure your brand is well-positioned for success.

– Data-Driven Insights: Through our access to extensive market data, we provide insights specific to your brand and category. This enables you to make informed decisions, target the right audience, and position your products effectively in China’s competitive landscape.

– E-Commerce Optimization: Our team helps optimize your brand’s presence on leading platforms like Tmall and JD.com, ensuring maximum visibility and engagement during key shopping festivals like Double 11 and 618. We also help you leverage Xiaohongshu and Douyin to build a direct connection with consumers.

– Influencer and Social Commerce Campaigns: China’s parenting community is highly engaged with social media and influencer content. We’ll help your brand connect with trusted influencers to drive authentic, word-of-mouth marketing that builds credibility and trust with Chinese parents.

Source: iAudience Data as of July 2024

The Next Step: Unlock Your Brand’s Potential in China

The opportunities in China’s baby and maternity market are vast, and now is the time for international brands to make their move. Despite fewer babies being born, parents are more focused than ever on buying the best products for their children—creating a premium market with resilient growth.

AsiaAssist is your trusted partner to help you tap into this thriving market. Schedule a call with us today to discover how we can provide data insights specific to your brand, navigate the intricacies of the Chinese market, and develop strategies that will propel your success in China.

With our expertise and access to cutting-edge market data, we are confident that your brand can thrive in China’s e-commerce landscape.

Ready to explore the opportunities in China? Contact AsiaAssist today to schedule a consultation.