Record-breaking Insights from 2024 China Double 11: Key E-commerce Trends for Global Brands

The 2024 China Double 11 shopping festival has concluded, setting new records and offering valuable insights into the evolving e-commerce landscape. According to Syntun’s monitoring data, total sales during this year’s event reached an impressive $197.2 billion USD (1.44 trillion RMB), with notable performance across various platforms and product categories.

Record-breaking Insights from 2024 China Double 11: Key E-commerce Trends for Global Brands

Syntun’s data reveals the following breakdown of sales by platform type during Double 11:

- Comprehensive E-commerce Platforms (Tmall, JD, etc.): These platforms accounted for $152.1 billion USD (1.1093 trillion RMB) in sales, with Tmall leading, followed by JD.

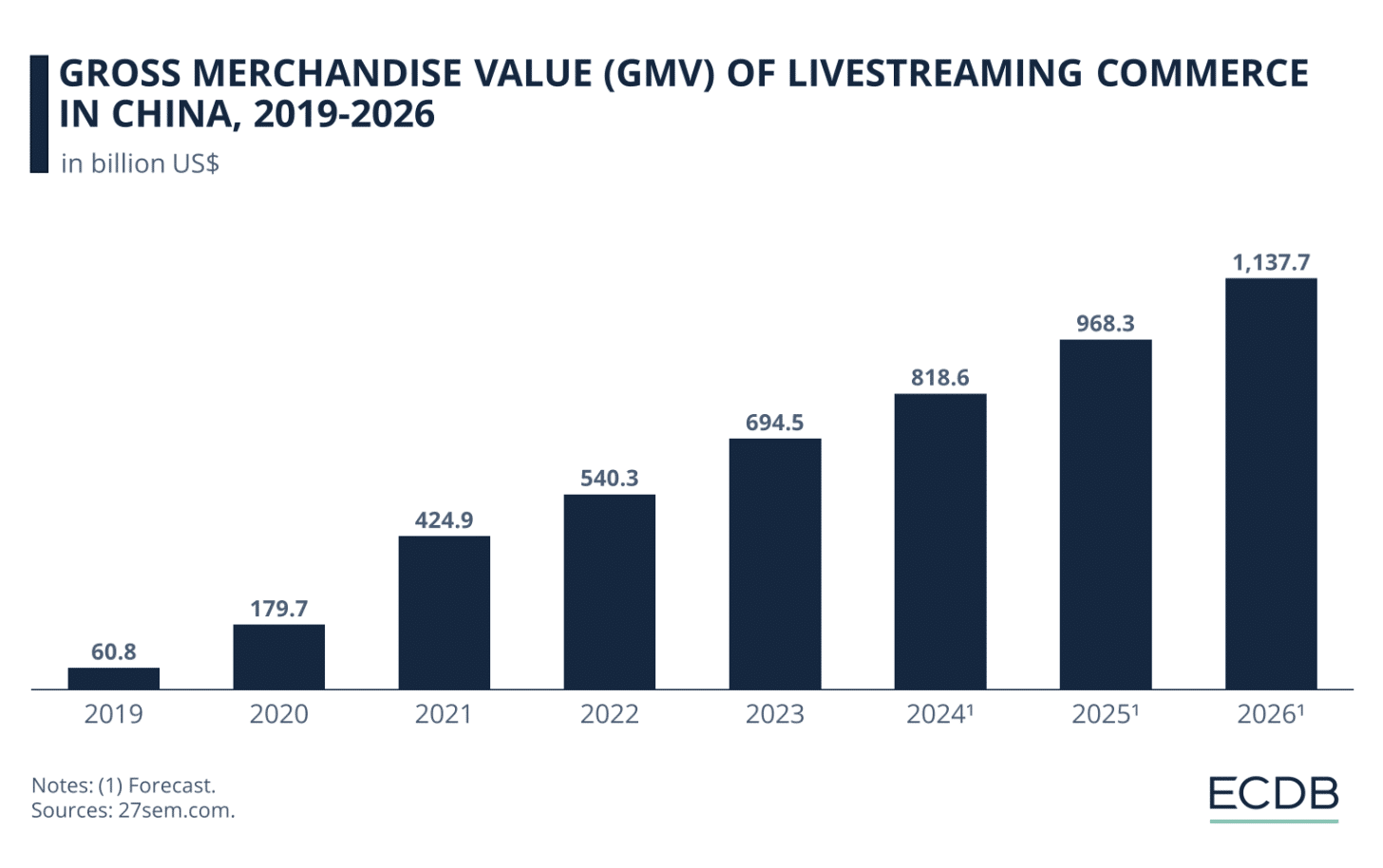

- Live-streaming E-commerce Platforms (Douyin, Kuaishou, Diantao, etc.): Live-streaming sales reached $45.5 billion USD (332.5 billion RMB), with Douyin (China’s TikTok) remaining the top player in this space.

- Instant Retail Channels: Instant retail platforms saw $3.8 billion USD (28.1 billion RMB) in sales, with Meituan Flash Purchase leading the pack.

- Community Group Buying: This segment reached $1.9 billion USD (13.8 billion RMB), with Pinduoduo’s Duoduo Maicai, Meituan Youxuan, and Xingsheng Youxuan taking the top three spots.

These figures showcase the continued dominance of comprehensive e-commerce platforms and the rise of live-streaming e-commerce as key drivers of consumer spending.

Key Product Categories: Growth and Opportunities

While various categories performed well, sports & outdoor products saw significant growth, driven by China’s increasing focus on fitness and outdoor activities. The sports & outdoor category reached $5.8 billion USD (42.3 billion RMB) in sales, reflecting an 18.6% year-over-year growth. As more consumers invest in health-conscious products and outdoor gear, the demand for high-quality sports equipment and apparel continues to rise, particularly among younger generations. This growing trend presents a strong opportunity for international sports brands to expand their presence in China’s e-commerce space.

In addition to sports & outdoor, cosmetics (personal care & beauty) and baby & mom products were also top-performing categories. The personal care & beauty segment reached $13.5 billion USD (96.3 billion RMB), with a 22.5% increase compared to the previous year, indicating the sustained consumer demand for high-quality beauty products.

The baby & mom category achieved $6.1 billion USD (43.6 billion RMB) in sales, growing by 12.6% year-over-year, highlighting the continuing focus of Chinese families on premium products for infants and children.

These categories—sports & outdoor, cosmetics, and baby & mom—provide strong opportunities for international brands looking to capture market share in China by offering premium and innovative products that cater to these growing consumer needs.

Establishing a Direct Presence on Leading E-commerce Platforms

For international brands seeking to expand in China, establishing a direct presence on key e-commerce platforms is crucial. Platforms like Tmall, JD, Douyin (China’s TikTok), and RED (also known as Xiaohongshu) offer brands the opportunity to connect directly with Chinese consumers, manage their branding and sales strategies, and reach a vast and engaged audience.

By setting up a flagship store on these platforms, brands can:

- Control their product listings, marketing, and customer experience.

- Leverage the platforms’ built-in traffic and consumer trust to boost visibility and drive sales.

- Engage with a highly targeted audience through personalized marketing, live-streaming, and influencer partnerships.

Platforms like Tmall and JD dominate the e-commerce space, while Douyin and RED are emerging as essential players in social commerce. With the increasing importance of live-streaming and social-driven purchases, establishing a flagship store on these platforms allows international brands to fully tap into China’s fast-evolving digital economy and consumer behaviors.

Consumer Behavior Shifts: Quality and Engagement

The 2024 Double 11 also revealed important shifts in consumer behavior:

- Quality over Quantity: Shoppers are increasingly prioritizing long-term value and quality, rather than simply chasing discounts. This trend is particularly prominent in categories like sports & outdoor goods, where consumers are willing to pay a premium for trusted brands offering durable and innovative products.

- Social Commerce and Livestreaming: Platforms like Douyin and RED continue to lead in social commerce, with live-streaming and influencer marketing driving significant consumer engagement. Brands that effectively use these platforms can build direct relationships with their audience and drive higher conversion rates.

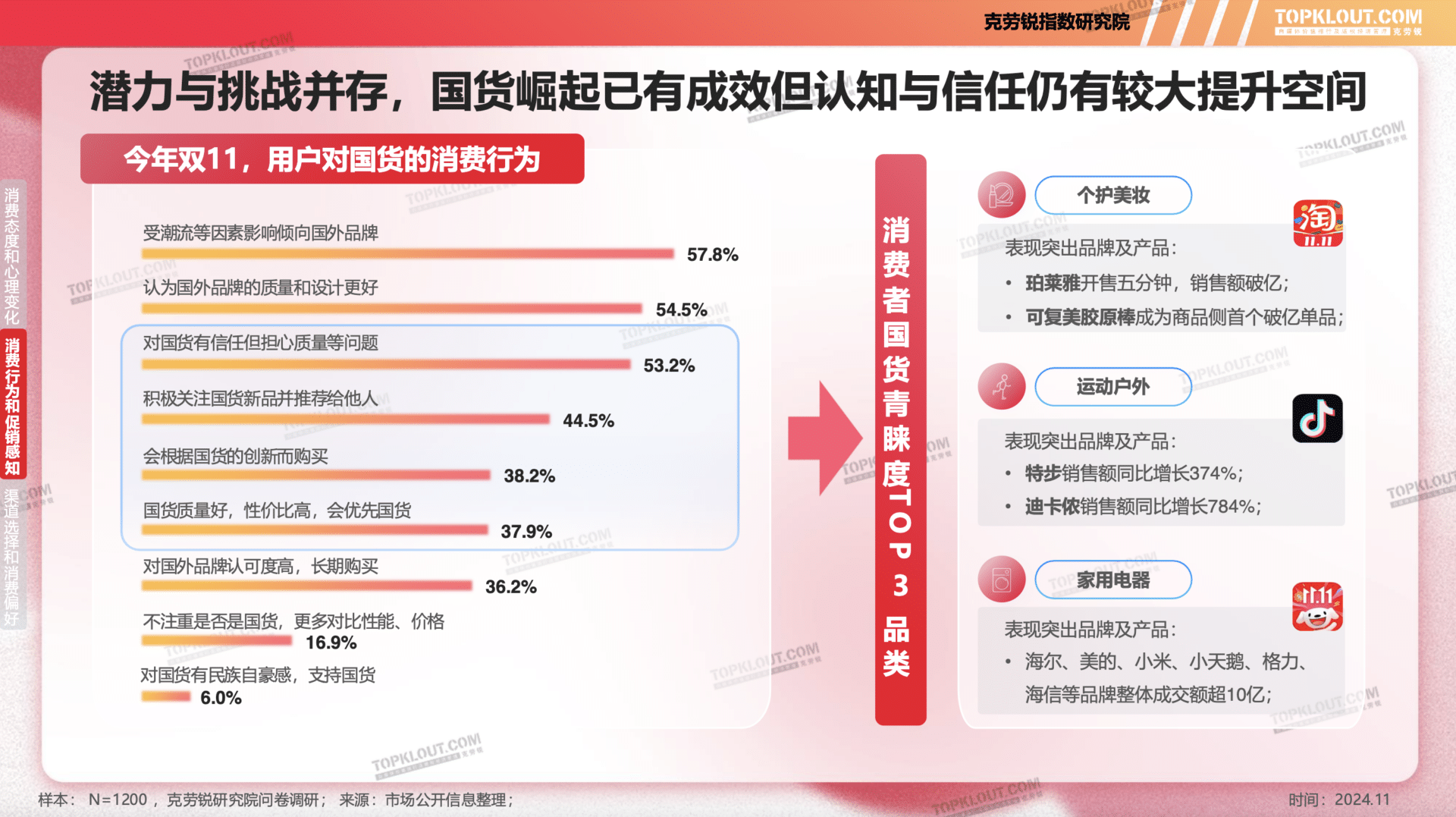

This image highlights key trends in consumer attitudes towards domestic and foreign brands during Double 11. On the left, consumers favor foreign brands for three main reasons: better quality and design (57.8%), perceived higher product quality (54.5%), and long-term brand loyalty (36.2%). On the right, Decathlon is the notable foreign brand in the “Sports & Outdoor” category, showing an impressive 784% sales increase.

Opportunities for International Brands

For international brands, Double 11 2024 highlights several key opportunities:

- By opening a flagship store on platforms like Tmall, JD, Douyin, or RED, brands can establish a direct connection with Chinese consumers, control their brand narrative, and leverage digital tools like livestreaming and influencer marketing to drive sales.

- The growing importance of social commerce and livestreaming suggests that international brands should consider creating engaging, interactive content that resonates with Chinese consumers, particularly through influencers and KOLs.

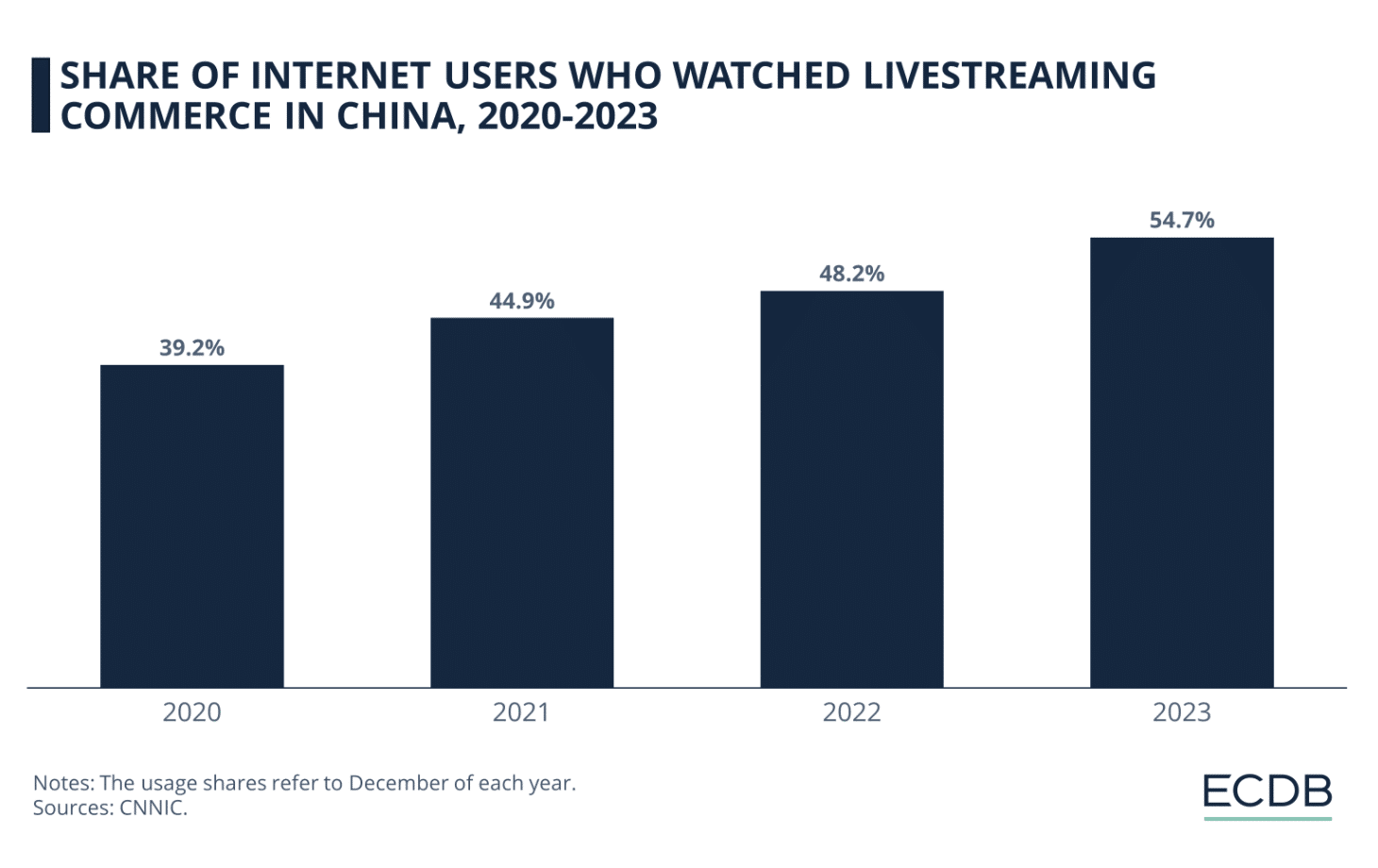

Since 2020, the share of internet users in China who watched livestreaming commerce has increased steadily. While the usage rate remained below 50% until 2022, it surpassed 50% in 2023, reaching 54.7%.

Conclusion: Navigating the Future of E-Commerce in China

As China’s e-commerce landscape evolves, brands must stay agile and focus on building direct relationships with Chinese consumers. If your brand is interested in exploring opportunities in the Chinese market, feel free to contact us for more information and assistance.